We are on day four of the extended measures taken by The Government to supress the spread and impact of COVID-19 on the country. Politicians on all sides don’t appear to like the phrase “lock down” but they, and the media, still use it so we will use it too.

Later today (25th March) we expect further announcements on extra support for freelancers and self employed (sole traders), we still await further information on the brand new employment status “Furlough”. In advance of this, we have pulled together the latest information and guidance on business closures and business support measures aimed at getting us through these difficult times.

Business Closures

On 20th March, The Government ordered the closure of pubs, clubs and other leisure related businesses, following which an extensive list of closures and exceptions was published – the full list is on this .Gov website:

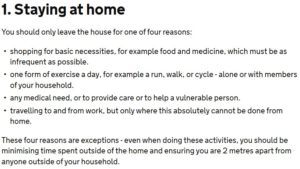

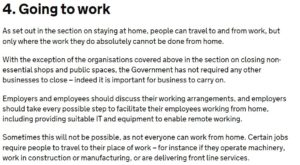

Businesses that provide essential services should stay open, businesses that can operate remotely and people in all businesses that can work remotely (e.g. from home) must do so. Contradictory guidance has been circulating about, but we think online advice is clear and businesses not explicitly told to close should stay open provided they adopt safe distancing and other measures to mitigate the risk and spread of the virus. These snips have been taken from the website and the link is also below:

Full details are on this .Gov website:

Business Support – Furlough

The Government clearly wants businesses to survive the disruption and, wherever possible, people to remain employed. To that end, the most radical initiative is the effective creation of a new employment status – furlough (the Coronavirus Job Retention Scheme). We still need to know the ins and outs but in summary this is what it entails:

- People remain as employed

- We don’t know if they accrue holidays or other entitlements while on furlough

- They are effectively laid off and won’t be allowed to do any work for the employer during the furlough period

- The Government will pay 80% of pay (via HMRC and an online portal which has yet to be created) up to a maximum of £2,500 per month. Employers can choose to top up pay to normal levels

- We don’t know whether that is net or gross pay

- We don’t know whether furlough can be turned on and off or rotated between different employees

- We don’t know how pay for employees with variable hours will be calculated

- We don’t think there is a limit to the number of employees that can be furloughed

- We don’t know how this will apply to company directors

We expect to learn more later and will keep you informed

Cash Grants for Businesses

- Businesses with premises that currently qualify for small business rate relief (SBBR), rural rate relief (RRR) and tapered relief will receive a one-off grant of £10,000. This will be administered through the local authority and paid in April. Businesses will automatically be contacted by their local authority (Calderdale have a link on their website, Kirklees are sending a letter – not sure how you get that if the business premises are closed.)

- Cash grants for retail, hospitality and leisure businesses:

- Businesses in these sectors with a property that has a rateable value of £15,000 and under will receive a grant of £10,000

- Businesses in these sectors with a property that has a rateable value of between £15,000 and £51,000 will receive a grant of £25,000

Business Interruption Support

The Government has introduced a temporary Coronavirus Business Interruption Loan Scheme to support SMEs with access to loans, overdrafts, invoice finance and asset finance of up to £5 million and for up to 6 years. It will also make a Business Interruption Payment to cover the first 12 months of interest payments and any lender-levied fees, so smaller businesses should benefit from no upfront costs and lower initial repayments.

Additionally, the government will provide lenders with a guarantee of 80% on each loan (subject to pre-lender cap on claims) to give lenders further confidence in continuing to provide finance to SMEs. The scheme will be delivered through commercial lenders, backed by the government-owned British Business Bank. More information and details of the 40 approved lenders via this link:

Other Business Support Measures:

- VAT Payments deferred from 20th March to 30th June and businesses will have till the end of March 2021 to repay any deferred payments

- Statutory Sick Pay covering 14 days of Coronavirus related absence without the need for a fit note or medical confirmation – although isolation notes are now available online from NHS111 if required by the employer

- Business rates holiday for retail, hospitality and leisure businesses

- Support for nursery businesses that pay business rates

- Taxation time to pay support for businesses and self employed in financial distress